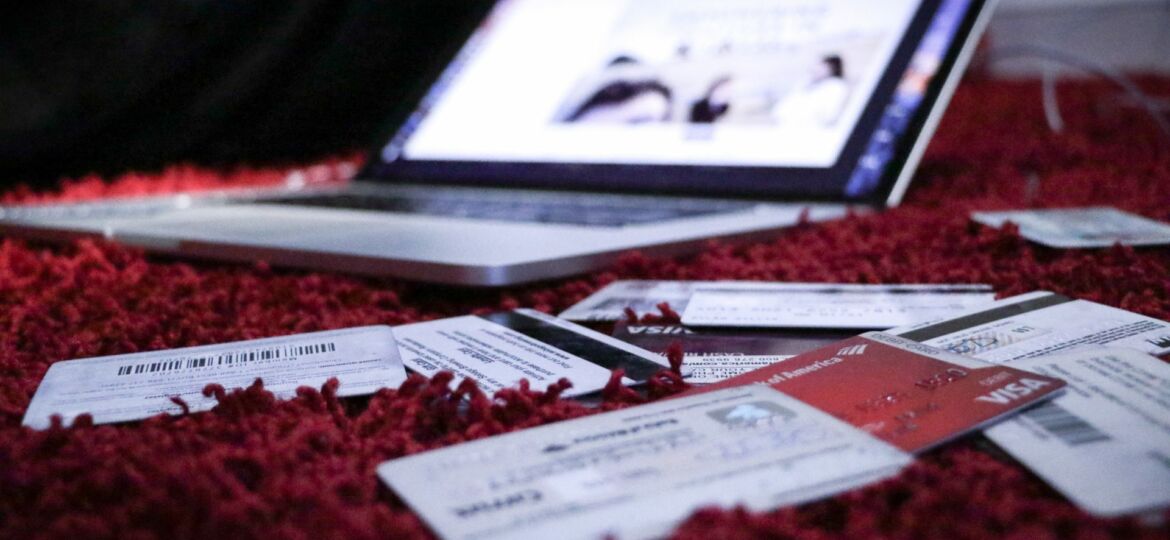

Debt management is a structured and ordered way in which to get on top of debts and financial obligations. Managing debt in a formal way is often required where people have borrowed too much money online or otherwise, and when debts start getting out of control, leading to a spiral of further debt. If you are looking for a quick loan to help you manage an unexpected cost until your next payday, you may find yourself looking for any applying for payday loans online, or going from payday store to payday store.

However if you have debt problems from multiple bills and loans then it might be time to start thinking about debt management, particularly if you are finding that using short term loans to pay your bills is happening more regularly. Debt management is a key part of understanding and controlling your finances. Setting financial goals and creating budgets can help us manage our money much better and just undertaking debt management where it is needed can help you realize where you may have gone wrong with your finances in the past.

Many people are good at controlling the money that they have but many are not aware at the best ways of managing their debt, which can lead to people falling into a spiral of debt and more financial problems. Debt management is the best way to keep up with all of your different bills, especially if they have got out of your control.

There are many different methods you can employ to try and control your debt. This guide from Kallyss will help you better understand some of the best ways you can control your snowballing debt and try and get your financial situation under control.

What Does Debt Management Do?

Debt management is a controlled way in which to plan your finances, spending and general financial situation, in order to get your debt under control. Debt management may also lead you to looking into debt consolidation methods, where several debts are consolidated into fewer, more affordable and more regular repayments.

If you have many different bills, expenses, outgoings and loans that you need to repay and it is getting overwhelming, debt management might be the best option for you.

The main goal of debt management is to use strategies to help you lower your current debt and keep it low in an effort to eventually eliminate it all together. You can create a debt management plan by yourself, using the internet to help, or you may look to go through credit counselling to help you with your plans and managing your debts.

Different Types of Debt Management

There are a few different ways that you can begin when looking to manage your debts; usually this is done by yourself, creating a plan that is suitable for you in the first instance.

It doesn’t matter if you have for example taken out a payday loan in Ohio and then moved state and perhaps applied for payday loans in Texas, affecting your credit score, debt management is designed to help you manage all financial responsibilities and obligations, whether you undertake debt management by yourself or through a third party.

However it is also possible to take the advice of a credit counsellor who can help you make the best plan and give yourself some accountability for if things begin to take a turn for the worse.

Individual Debt Management

You can debt manage by yourself, creating a plan and game-plan using resources from the internet and advice from family and friends.

You should create a spending budget for yourself and give yourself spare money to pay off your bills and loans monthly, allowing yourself to achieve some sort of stability. You should also understand a be clear where and why you need to borrow money, if at all and where you can avoid doing so, to avoid any potential debt traps.

There are resources all across the internet and elsewhere to help you with your own debt management plan such as repayment calculators or budget calculators as well as mobile apps which are made for this purpose alone. First and foremost, you should always try to repay any loans and credit back on time or early to avoid late fees, penalties and further debt and damaging your credit score.

Talking to your lenders and explaining that you are struggling with your debt is an important part of creating a debt management plan as they may be able to offer you longer to pay off your loans, giving yourself some time to breathe.

Using a Credit Counsellor For Debt Management

Another way that you can start managing your debts is by using a credit counsellor to help you. There are many charities and organisations in the US that will provide a credit counsellor free of charge if you are seriously struggling with your debt. If you find yourself with many outstanding loans and financial obligations needing paying off, you may look to friends and family first, before seeking the help of professionals and any third parties.

Remember though, if you have used a friend or family member as a loan guarantor, there may be additional implications if you do not repay the loan on time that will affect them.

A credit counsellor can help you come up with the best plan for your specific circumstances and can help you negotiate this with your creditors. The plan will hopefully allow you to eliminate your debts as quick as possible.

Does Debt Management Affect Your Credit Score?

Some debt management may affect your credit score unknowingly and therefore it is important to check what your creditors are doing when you negotiate with them.

Some lenders may also trigger a hard credit search into your credit file, leaving a credit footprint. These can stay on your record for up to 12 months and may well impact your credit score.

However, by negotiating a better deal with your creditor you will be more likely to be able to consistently pay off your debts, making your credit score go up and improve for the future dramatically.

It is important to note that debt management is not a one-size-fits-all policy and it may not completely eliminate your debt by the end of your plan. Look into alternatives such as a personal loan in order to help you weather the storm whilst you find the money you need to pay off your debt.