Get a 6 Month Loan Fast with Kallyss!

A 6 month loan might be exactly what you need to get out of a difficult financial situation. Financial emergencies are common and unpredictable, but there are ways to get financial support. Apply for a 6 month loan online today with Kallyss to start borrowing money instantly. No hidden costs or upfront fees, submit a loan request form today through Kallyss.

We’ll help you find the best personal 6 month loan – and quick! Get started today.

A 6 month loan is a short term personal loan which is repaid over a period of 6 months. Unlike payday loans, 6 month loans allow borrowers to repay over a more manageable time period. These types of loans are great for financial emergencies or temporary expenses, which cannot be paid by your current income and financial situation.

6 month loans, as personal loans, can be used for a variety of personal reasons. As an established loan matching service, Kallyss will also help you find the best direct US lender for your next 6 month loan. To get started today all you need to do is apply online by filling out one of our loan request forms. Instant decisions and quick funding. We’ll give you that financial boost you need with a 6 month loan.

As 6 month loans are categorized as short term personal loans, these are typically used for financial emergencies. For instance, when you incur an expected or high bill or expense which is temporary – yet, needs to be paid fast before accruing interest and more debt! 6 month loans, therefore, are a great option for those who’ve found themselves in financial difficulty but need that extra help temporarily to help them in the long-run.

You can use a 6 month loan for a variety of purposes. Get help today and ask for a 6 month loan with Kallyss!

Use a 6 month loan for:

- Medical bills

- Veterinary bills

- Vehicle repairs

- Travel costs

- Unexpected energy bills

- One-off payments

- Home repairs

Just like other short term personal loans, 6 month loans are great for times when you incur an unexpected bill or cost. Keep in mind, however, that 6 month loans should not be used for any ongoing debts or payments you may have – such as a mortgage, rent or other similar bills. Using a 6 month loan for long term debt is strongly advised against, and doing so could cause you more financial problems and debt.

Apply online today with Kallyss and borrow $100 to $35,000 – repay the loan in 6 months, or, if you need longer contact the direct US lender we match you to. Whatever amount you’d like to borrow and what for, Kallyss will help.

Am I Eligible for a 6 Month Loan with Kallyss?

Applying for a 6 month loan, or any other type of loan whether it be a bad credit loan, payday loan or installment loan – is truly fast with Kallyss! We guarantee you will receive your money, whether that be $500, $2000 or even $5000 within under an hour, by 24 hours or at the latest the next business day. Using Kallyss for your 6 month loan guarantees an instant decision and fast funding for your financial needs.

In order to be eligible for a 6 month loan, and all of our other available loans, you must meet our eligibility criteria. To receive money fast with Kallyss you must:

If you have met all of the above criteria, then you can get borrowing money fast online today with Kallyss. Get your 6 month loan online and fast with Kallyss now. Get started by filling out one of our online loan request forms here.

Yes. You can still apply online with Kallyss for a 6 month loan, and all of our other loans, even if you have a bad credit score or a bad credit history. Having a bad credit score will, unfortunately, limit your options when it comes to borrowing loans. However, we understand that not everyone is in the same financial situation and that’s why we will accept and consider applicants even with bad credit for 6 month loans.

Once you have submitted your online loan request form to us, we will then use our loan matching technology to match you to the best possible direct lender for your 6 month loan. Our network of direct lenders are reliable, and many will still consider applicants with bad credit. Get a 6 month loan online today and start rebuilding your credit.

Keep in mind if you have bad credit you will still need to meet our eligibility criteria to borrow a 6 month loan.

Fast Approval

We provide instant decisions and fast approval. Get a 6 month loan fast online today with Kallyss – we will match you to one of our trusted US direct lenders.

Bad Credit Considered

Bad credit applicants are also considered. We understand not everyone has a good credit score, so those with bad credit scores or history can still apply online for 6 month loans.

Manageable Repayments

Our 6 month personal loans are short term loans. Get instant funding and repay the money back over a period of 6 months, this way, borrowing money is more manageable.

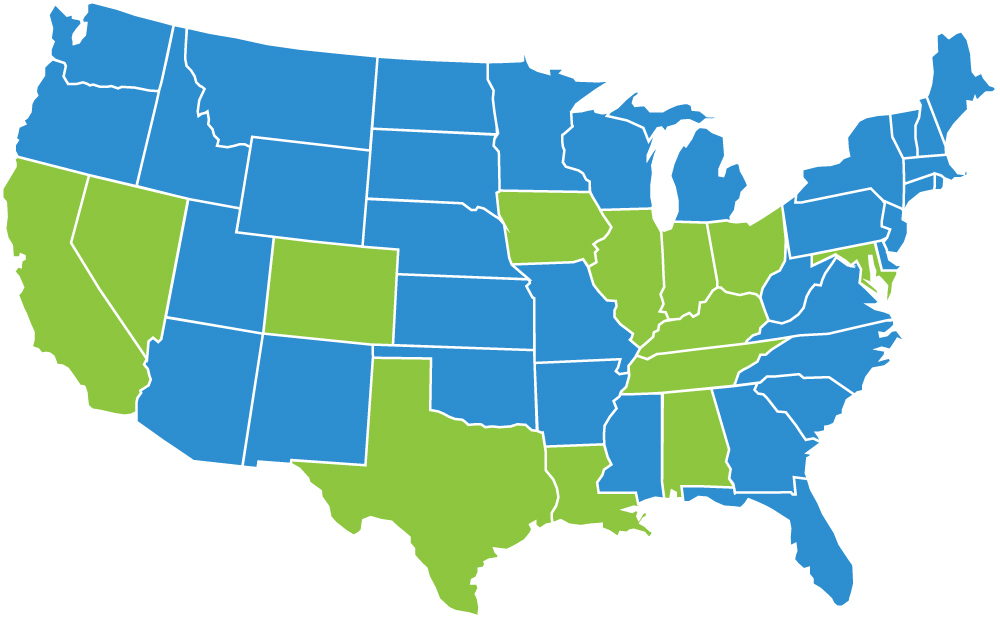

Which States Does Kallyss Operate In?

In order to apply for a 6 month loan you must have an address and live in a US state where it is legal to borrow loans online. Some states do not legally allow payday lending or other forms of personal loans. However, Kallyss operates in most states in the US where 6 month loans are legal and permitted by state and federal laws. We are always working to add more US states.

If you’d like to borrow a 6 month loan but are unsure if we operate in your US state, check our our list of states we lend money in below:

Like other short term loans, 6 month loans are typically used for unexpected costs or temporary expenses. As the name implies, 6 month loans are repaid over a set period of 6 months. Just like other loans, the direct lender we match you to will set out terms and agreements alongside when and how you repay the loan.

6 month loans, when compared to payday loans, may be more manageable to repay. You won’t need to repay the loan back instantly – whether you borrow $300, $500, $3000 or more – and repayments will be automatically set up and deducted from your nominated bank or checking account.

If you would like to repay the 6 month loan over a longer period of time as you are struggling financially, then we strongly advise you get in touch with your direct lender as soon as possible.

There are many options available nowadays both online and in-stores to borrow loans. However, when choosing Kallyss for your next 6 month loan or any other personal loan, we will guarantee a fast, reliable and secure service.

Not all companies you find online are legitimate, and people often fall victim to this. Yet, Kallyss is a legitimate, authorized loan connections service which works with a large network of trusted US direct lenders. All of our lenders we work with aim to ensure you receive the loan you like quickly, and that your repayments are manageable.

Not only do we keep all of your personal and financial information confidential and secure, but we will also always be happy to provide more information or help wherever and whenever needed. We pride ourselves on our high-quality and friendly service, as helping people financially is at the heart of what we do.

We will always ensure our customers are satisfied, and if you ever experience a problem or have a concern then you can get in touch with us. Using Kallyss for your next 6 month loan will ensure a fast, reliable and hassle-free application process. We will also always make sure you meet our eligibility criteria, to ensure you are entitled to borrow money online and in the right position to borrow and then repay the 6 month loan alongside any accrued interest.

If this all sounds great for you, then you can get started online today by submitting an online loan request form. We don’t charge our customers either to apply for loans, and there are no hidden costs! We simply match you to the best direct US lender.

If a 6 month loan might not be right for you – you can check out our other short term personal loans we offer, such as payday loans, bad credit loans and installment loans.

There are many money borrowing options available if 6 month loans don’t sound fit for you – such as borrowing money from family or trusted friends. Yet, these options also have potential disadvantages if money is not repaid.

You could also consider asking for a cash advance on your wages through your employer. You can get the money you need fast – but, keep in mind money may be short when your next paycheck arrives.

We understand that 6 month loans might not be ideal for everyone, and we always advise applicants to consider their personal finances before applying and to remember that avoiding or missing loan repayments can lead to further fees and interest.

Apply Online Today for a Fast 6 Month Loan with Kallyss

If a 6 month loan sounds like the best short term personal loan for you, then you can easily get started online today and get the money you need and fast. Simply fill out our online loans request form, get fast approval and sit back and relax before the money is sent to your bank account directly!

It really is as simple as that.

Whatever you need, Kallyss can help today. Get started online today and get a 6 month loan now.

Read Related Guides

Lorem ipsum dolor.

Consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lorem ipsum dolor.

Consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lorem ipsum dolor.

Consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lorem ipsum dolor.

Consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.